So, in this example, for every pound that your company invests, it will receive a return of 20.71p. That’s relatively good, and if it’s better than the company’s other options, it may convince them to go ahead with the investment. If you’re not comfortable working this out for yourself, you can use an ARR calculator online to be extra sure that your figures are correct. EasyCalculation offers a simple tool for working out your ARR, although there are many different ARR calculators online to explore. Read on as we take a look at the formula, what it is useful for, and give you an example of an ARR calculation in action. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Rate of Return (RoR)

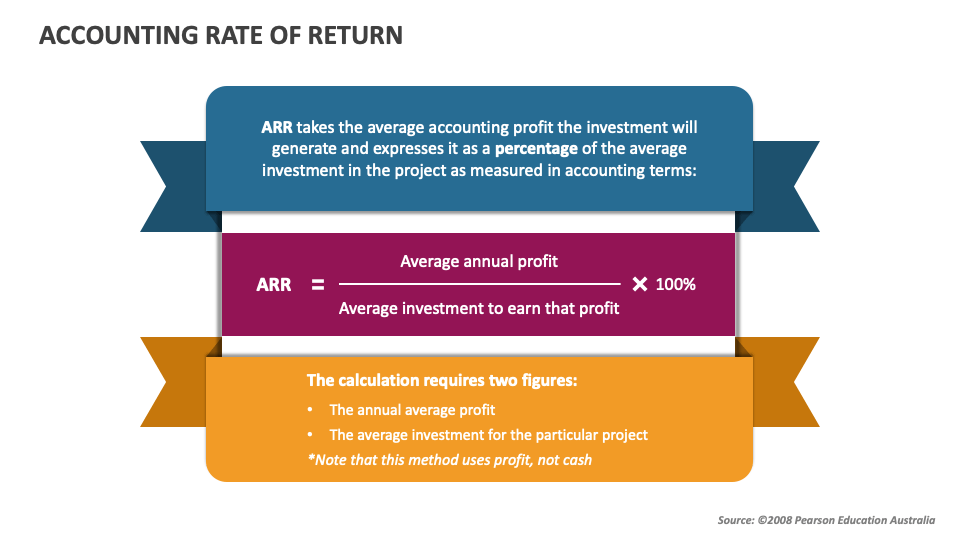

Another variation of ARR formula uses initial investment instead of average investment. The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project. Because of its ease of use and determination of profitability, it is a handy tool to compare the profitability of various projects. However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project.

Which of these is most important for your financial advisor to have?

Accept the project only if its ARR is equal to or greater than the required accounting rate of return. Like any other financial indicator, ARR has its advantages and disadvantages. Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly. It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making.

.css-g8fzscpadding:0;margin:0;font-weight:700;What is Accounting Rate of Return (ARR)?

This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk. The accounting rate of return is one of the most common tools used to determine an investment’s profitability. Accounting rates are used in tons of different locations, from analyzing investments to determining the profitability of different recording a cost of goods sold journal entry investments. If only accounting rate of return is considered, the proposal B is the best proposal for Good Year manufacturing company because its expected accounting rate of return is the highest among three proposals. ARR illustrates the impact of a proposed investment on the accounting profitability which is the primary means through which stakeholders assess the performance of an enterprise.

Company A is considering investing in a new project which costs $ 500,000 and they expect to make a profit of $ 100,000 per year for 5 years. HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks.

In this blog, we delve into the intricacies of ARR using examples, understand the key components of the ARR formula, investigate its pros and cons, and highlight its importance in financial decision-making. AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance.

The main difference is that IRR is a discounted cash flow formula, while ARR is a non-discounted cash flow formula. One of the easiest ways to figure out profitability is by using the accounting rate of return. There are a number of formulas and metrics that companies can use to try and predict the average rate of return of a project or an asset. We are given annual revenue, which is $900,000, but we need to work out yearly expenses. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Depreciation is a practical accounting practice that allows the cost of a fixed asset to be dispersed or expensed.

- This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure.

- Based on this information, you are required to calculate the accounting rate of return.

As such, it will reduce the return on an investment or project like any other cost. The P & G company is considering to purchase an equipment costing $45,000 to be used in packing department. The operating expenses of the equipment other than depreciation would be $3,000 per year.

The company needs to decide whether or not to make a new investment such as purchasing an asset by comparing its cost and profit. Average accounting profit is the arithmetic mean of accounting income expected to be earned during each year of the project’s life time. Average investment may be calculated as the sum of the beginning and ending book value of the project divided by 2.

The accounting rate of return (ARR) is an indicator of the performance or profitability of an investment. The denominator in the formula is the amount of investment initially required to purchase the asset. If an old asset is replaced with a new one, the amount of initial investment would be reduced by any proceeds realized from the sale of old equipment.

Here we are not given annual revenue directly either directly yearly expenses and hence we shall calculate them per the below table. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period.